Tianma gets OLED orders?

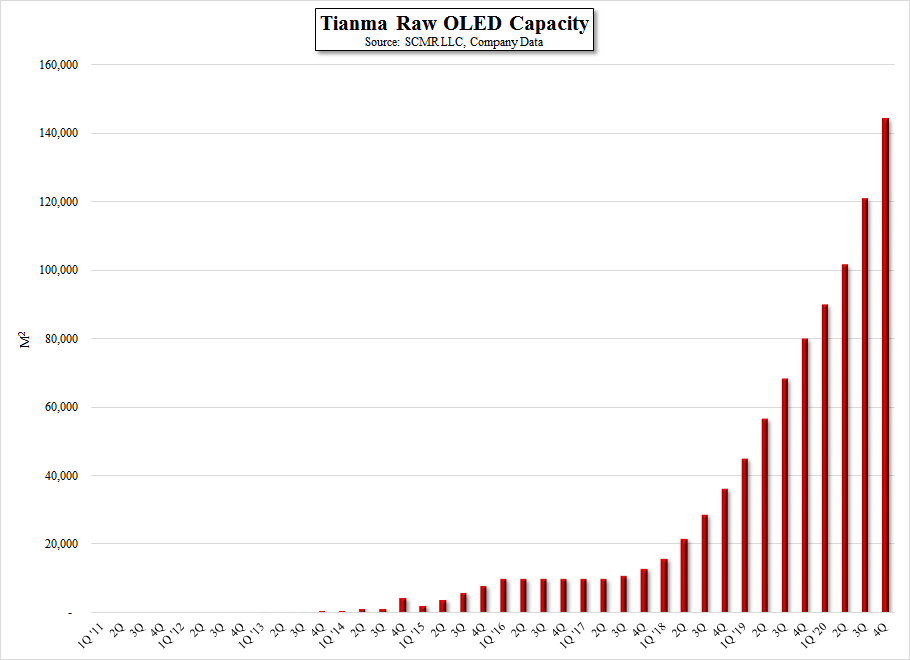

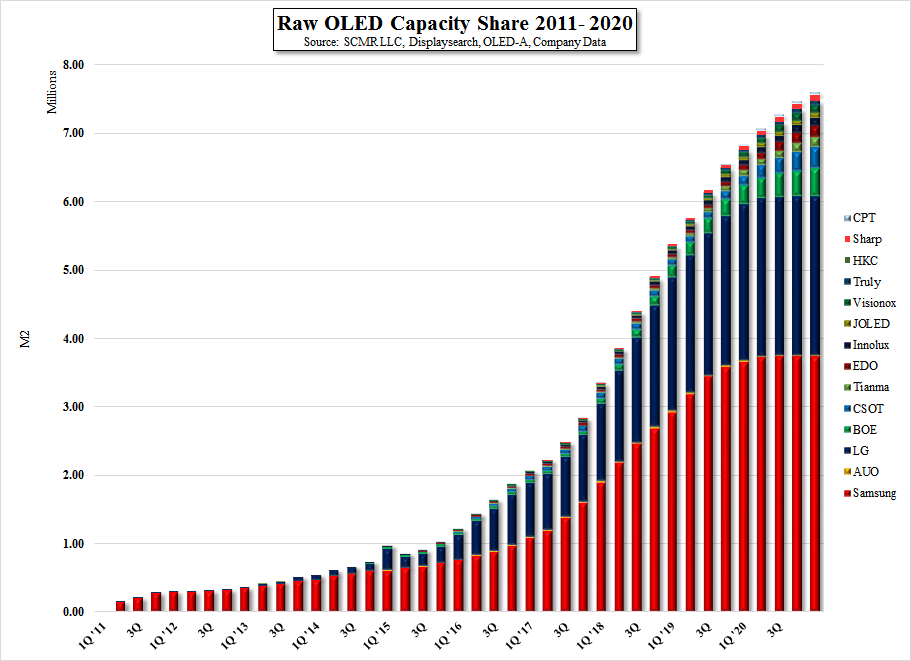

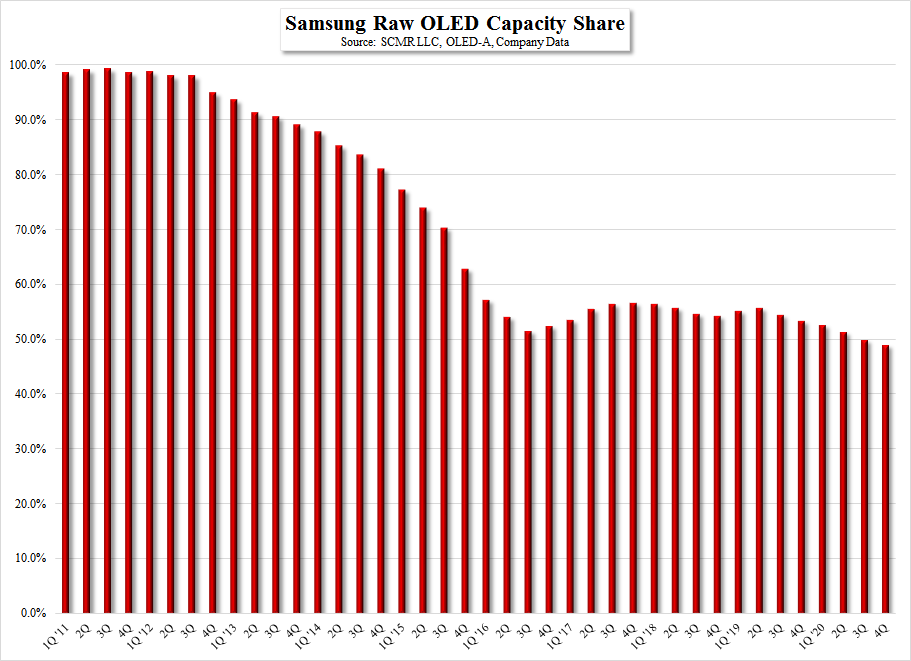

Unfortunately the order remains unconfirmed, and if true will likely be dependent on the Gen 6 line’s start date and ramp, but in any case, if this order is real, it would represent a significant step forward for Tianma’s OLED development and commercialization project. Tianma has a~1% share of the overall display market on a m2 basis, but has a ~3% share of the small panel display market (dollars), and has been a supplier of small panel LCD displays to the Chinese market for a number of years, which gives them the relationships with mainland smartphone vendors that would help them sell an equivalent OLED display. More than likely, Tianma will not be making much money on the order, if it goes through, as the new fab will likely be running at a low yield rate, but the idea is to get their foot in the door on OLED and even a small, money losing order from a recognizable Chinese smartphone manufacturer will go a long way toward building that business.

RSS Feed

RSS Feed