The fact that so many transfers are needed to produce a single micro-LED panel, and that the number of repairs needed, even at high yields, has kept the price of such devices in the six figure category. As Samsung is trying to release true consumer micro-LED TVs this year, much will rest on the success of such development programs. Toward that goal, Samsung has also partnered with AU Optronics (AUOTY), who is expected to be supplying glass TFT backplanes on which the micro-LEDs will be deposited. Those backplanes will drive the micro-LEDs using TFT technology similar to what is used to drive LCD and OLED displays currently.

|

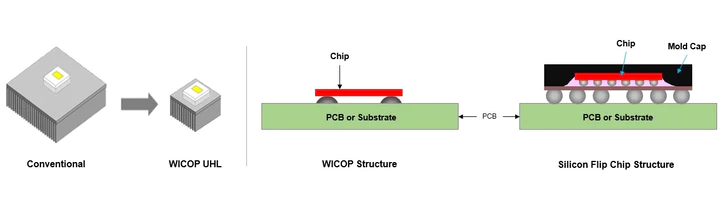

Sanan Optoelectronics (600703.CH) has been a primary supplier of mini-LEDs to Samsung Electronics, and as a top 10 global supplier, has been able to remain cost effective as Samsung continues to expand its mini-LED offerings. However, relying on a single supplier give Samsung less leverage than they are used to and has added South Korea’s Seoul Semiconductor (046890.KS) to its mini-LED supply roster, with the new entrant part of the supply chain for the Samsung NEO QLED TV line. Seoul Semi is hoping to expand that relationship to micro-LEDs in the future and has been promoting its Wicop technology, (Wafer Integrated Chip on PCB) which, unlike flip-chip technology that must be bonded, Wicop allows an unpackaged LED to be surface mounted, reducing size, weight, and power consumption. Samsung is also working toward changing its micro-LED production process from a single chip transfer system, which moves over 8.3m individual micro-LEDs of each of three colors to a product substrate (24.88m single transfers), to one where the red, green, and blue micro-LEDs are combined in one chip package, reducing the number of transfers to 8.3m instead of 24.9m. While this sounds logical, it means making sure that each RGB die is placed correctly on each tri-color die, which in itself is a daunting task, for which there are a number of potential solutions that need to be scaled to mass production levels.

The fact that so many transfers are needed to produce a single micro-LED panel, and that the number of repairs needed, even at high yields, has kept the price of such devices in the six figure category. As Samsung is trying to release true consumer micro-LED TVs this year, much will rest on the success of such development programs. Toward that goal, Samsung has also partnered with AU Optronics (AUOTY), who is expected to be supplying glass TFT backplanes on which the micro-LEDs will be deposited. Those backplanes will drive the micro-LEDs using TFT technology similar to what is used to drive LCD and OLED displays currently.

0 Comments

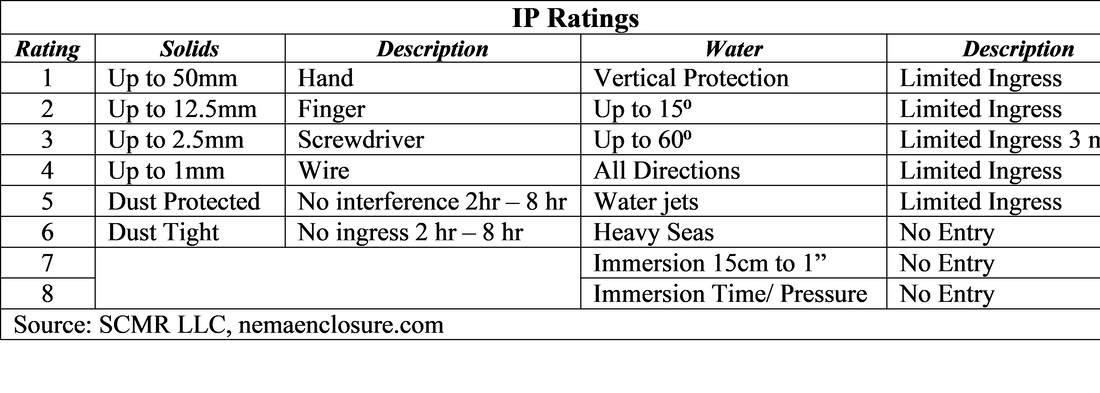

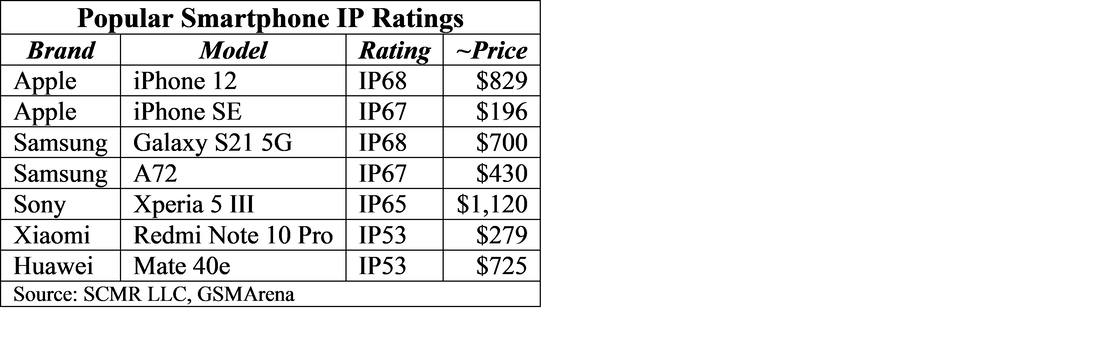

A Different Kind of IP |

AuthorWe publish daily notes to clients. We archive selected notes here, please contact us at: [email protected] for detail or subscription information. Archives

May 2025

|

RSS Feed

RSS Feed