Unsponsored ADRsVeeco (VECO) and Aixtron (AIXA.GR) are the two main players in the MOCVD (Metal Organic Chemical Vapor Deposition) market, with such tools being the crux of the LED manufacturing business. Veeco is currently listed on NASDAQ, however Aixtron, a German company listed on the Frankfurt Exchange, terminated their sponsored US ADR program in 2017. It seems that Citibank (C) has decided to create an ADR program for Aixtron by offering ADRs representing two Aixtron shares, however this is an unsponsored ADR, which means Aixtron will not be reporting results under US rules and is not involved with any aspect of the security. The Aixtron shares underlying the ADRs are held exclusively by Citibank and are not new or existing shares being offered by the company. The Citibank ADRs are currently being offered at a premium to their intrinsic value.

0 Comments

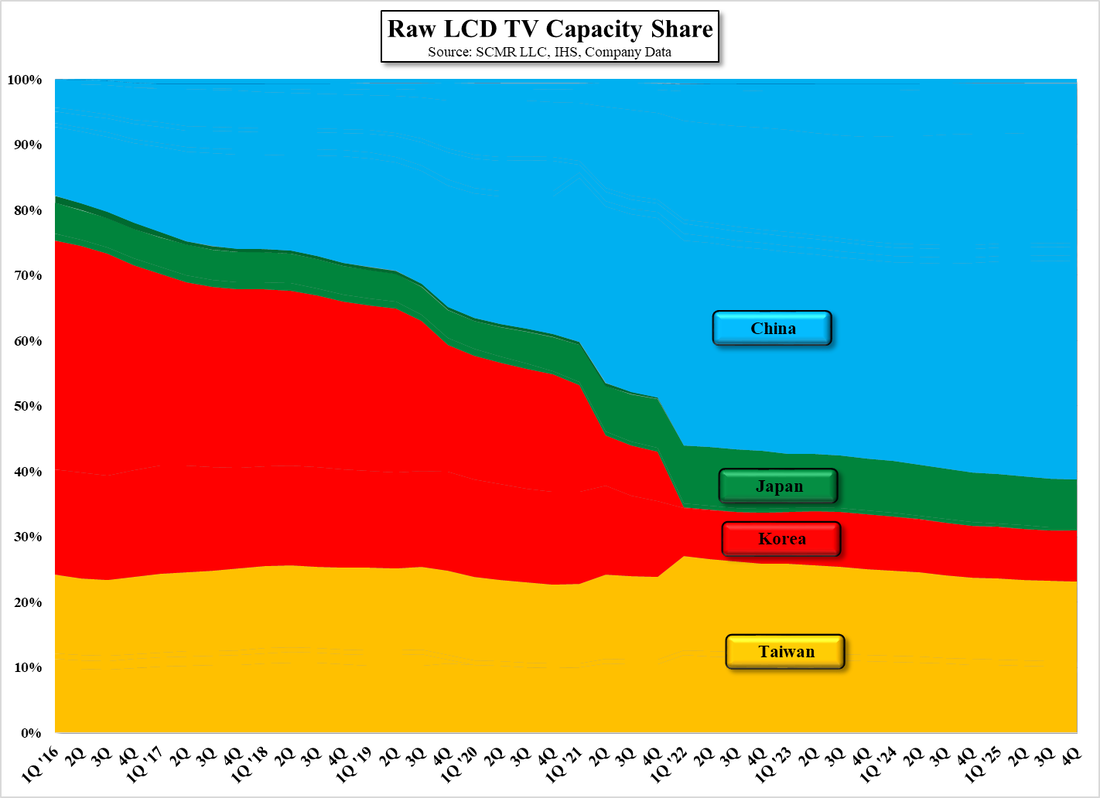

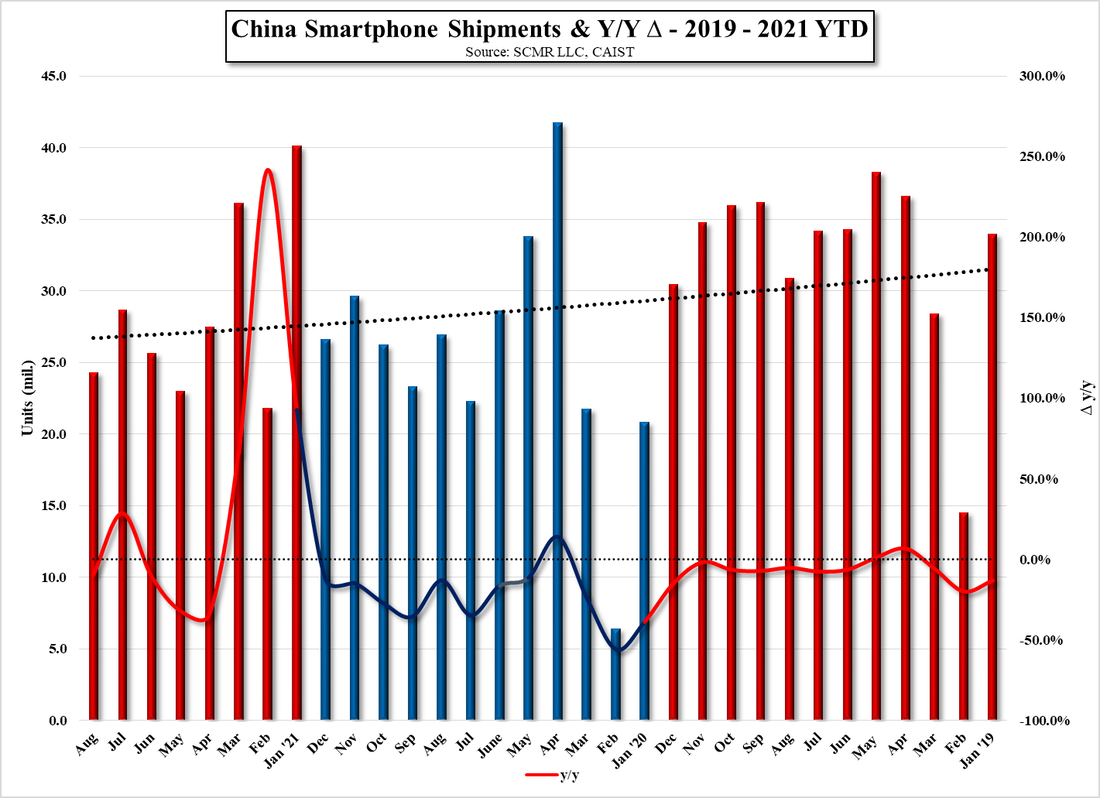

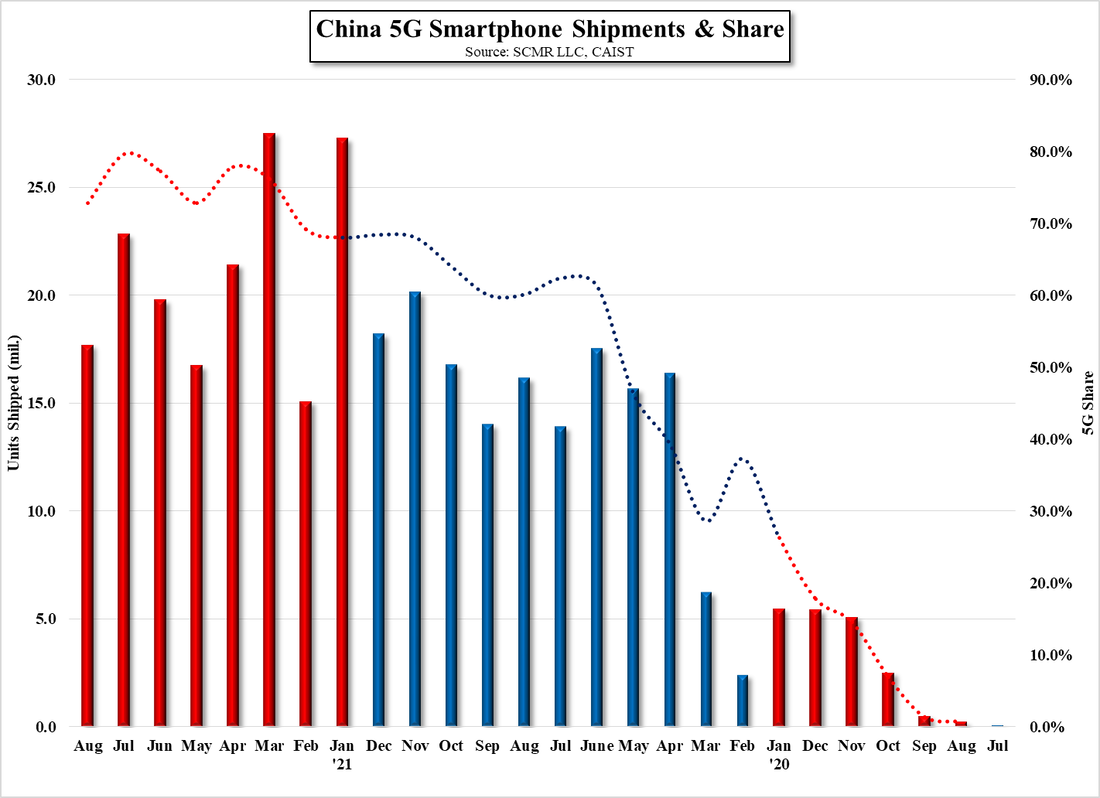

China LCD – Bigger, Better? |

AuthorWe publish daily notes to clients. We archive selected notes here, please contact us at: [email protected] for detail or subscription information. Archives

May 2025

|

RSS Feed

RSS Feed