Samsung Also…?

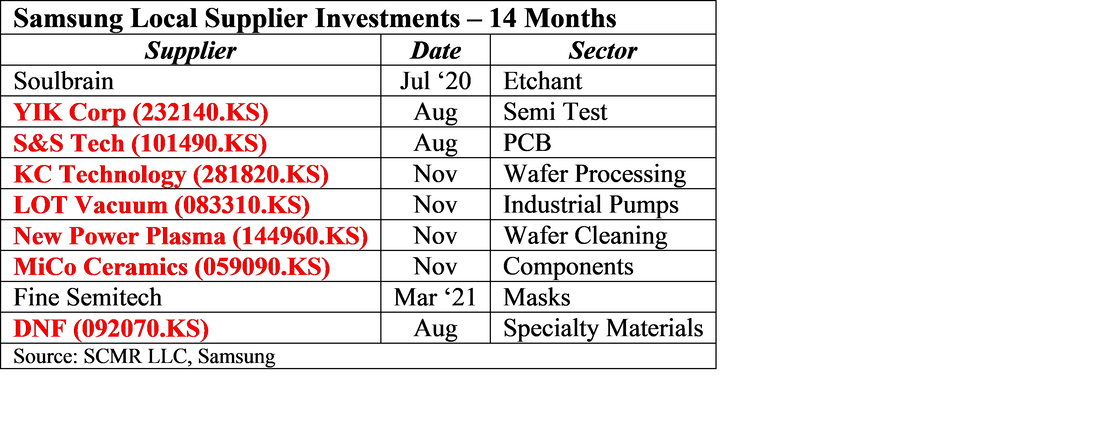

To those ends, Samsung embarked on a plan to make investments, some large and some small, in 9 South Korean companies that strangely were or are now part of the Samsung supply chain. In many cases these companies are developing or supplying products or components that Samsung was purchasing from suppliers outside of the country and found themselves part of the inevitable trade and/or political conflicts that entangle companies on a daily basis, but were also key, primary, or sole suppliers. By making such investments in local companies, Samsung has been laying the path to either creating a competitive pricing environment for out of country sources or to eliminate those entirely.

Samsung’s investment in public local companies over the last 14 months has totaled $234.4m US, but the size of the investments is far less important than the fact that it further cements these companies relationship with Samsung, who is not only a customer, but a source of information and expertise in a wide range of technologies. One obvious one that we have noted in the past is Soulbrain (036830.KS), a company that is a producer of Hydrogen Fluoride used to etch semiconductors. As Japan is the source for much of the world’s hydrogen Fluoride, a conflict between Japan and South Korea of WWII reparations caused some shortages in the material last year, and while some stability has been achieved, Samsung does not seem to be convinced that all is back to normal. We have also noted in the past the dominance of Japan in the production of FMM (Fine Metal Masks), with Dai Nippon Screen (7912.JP) essentially owning the market. Given that Samsung affiliate Samsung Display (pvt) would essentially close it doors if that supply line was damaged, they have included Fine Semitech (036810.KS) in their more recent investments to make sure that they can protect themselves from any disruption in essential components and materials.

RSS Feed

RSS Feed