And The Survey Says…

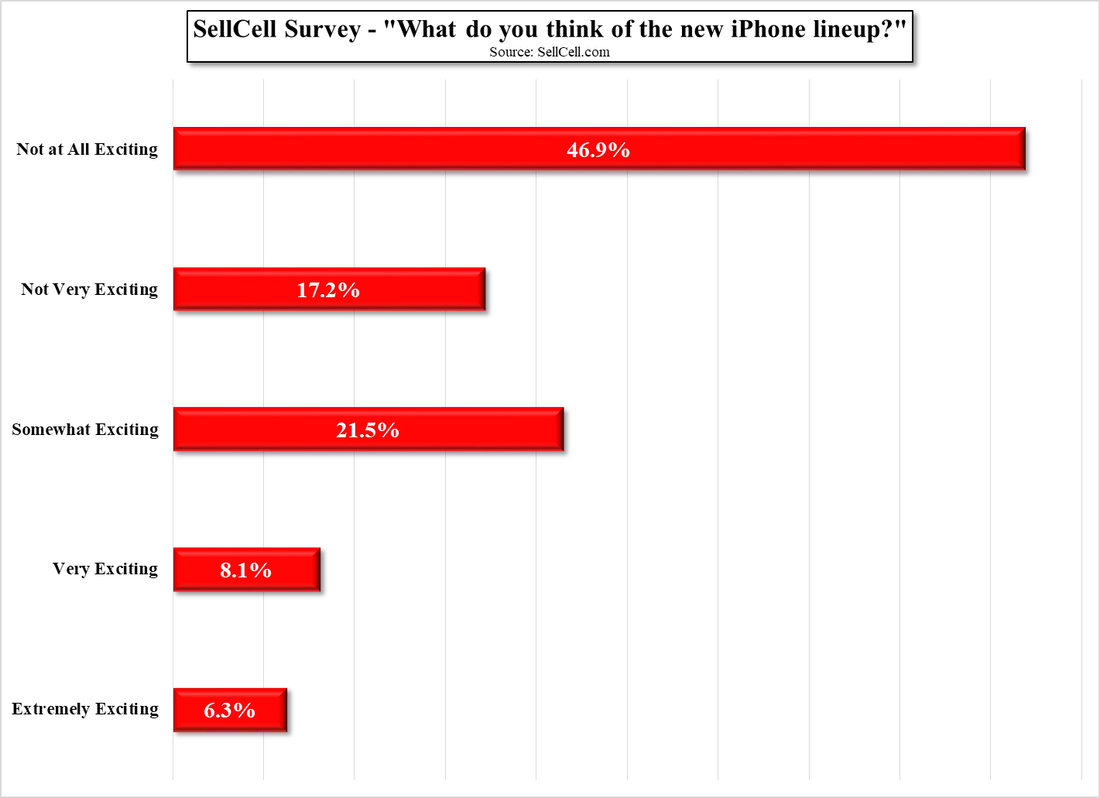

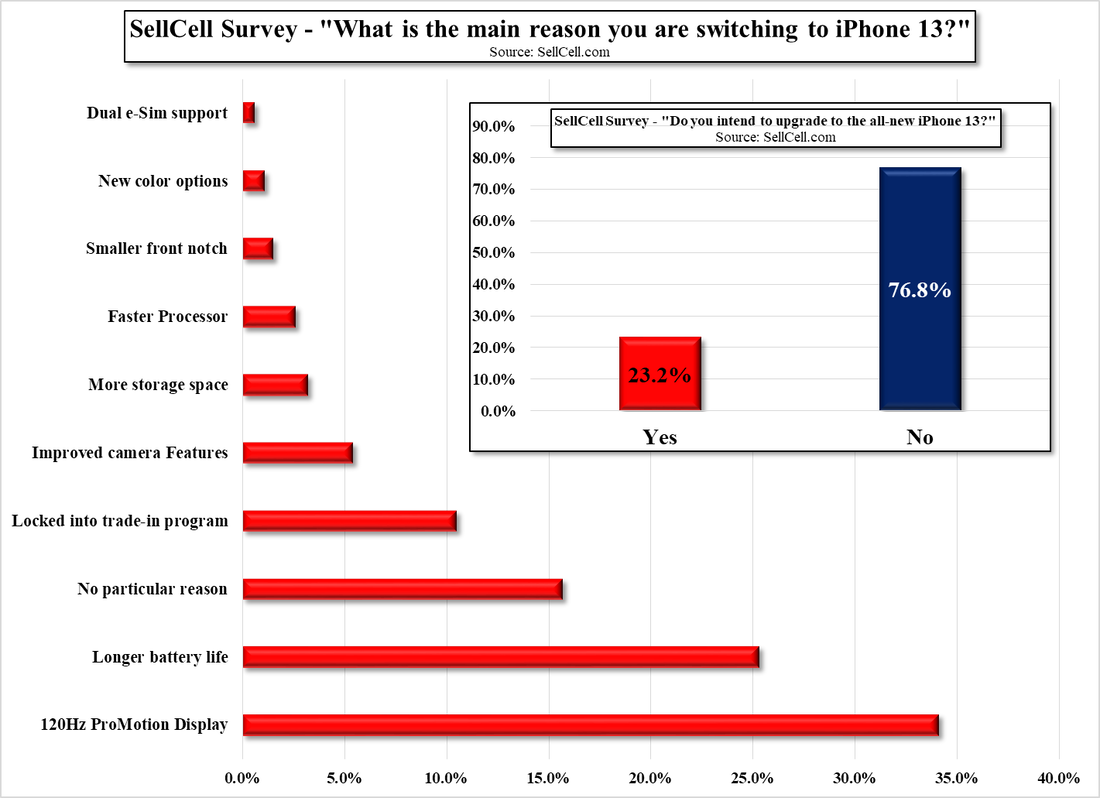

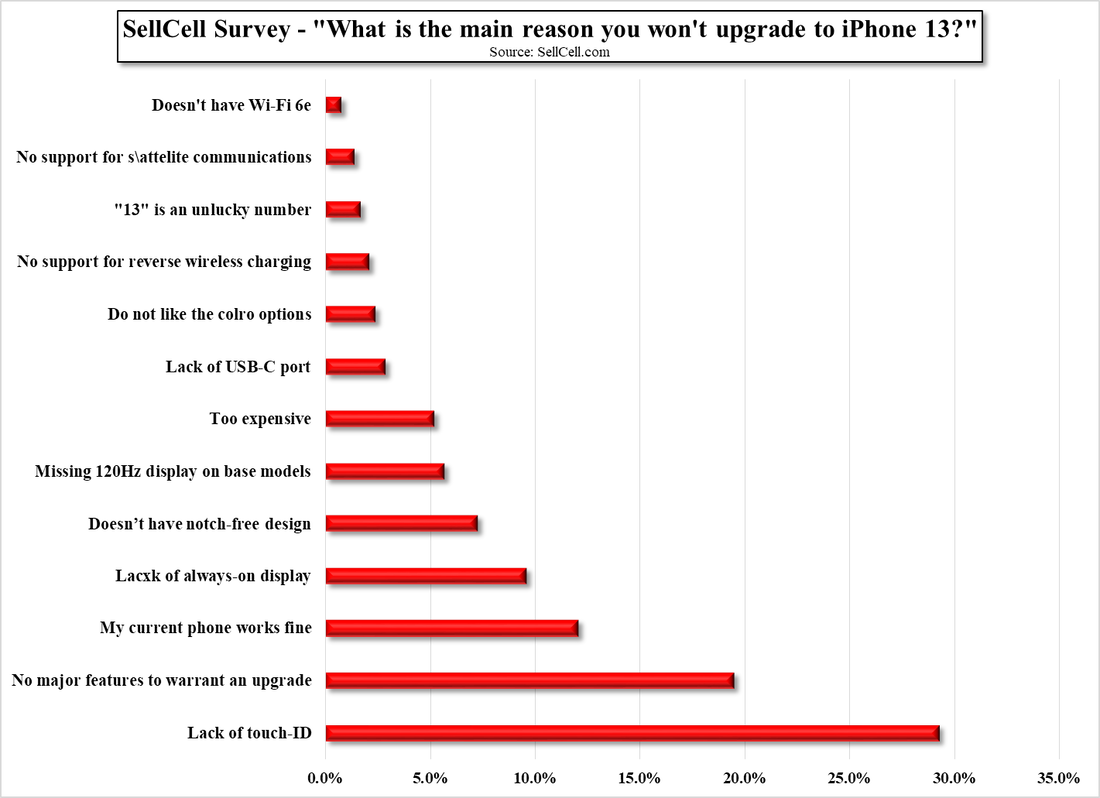

A number of the responses were surprising, particularly the fact that 64.1% found the iPhone 13 models “Not at all exciting” or “Not very exciting”. When it came to the features that attracted buyers to upgrade the 120Hz refresh rate was the most popular at 34.1%, considerably more than the 22% in the pre-release survey. Longer battery life came in 2nd at 25.3%, again much higher than the 8.3% in the pre-release poll. Under-display touch ID was the 2nd most popular feature in the pre-release survey, but did not even register in the final, but most telling was that 43.7% of respondents said they intend to upgrade to the iPhone 13 in the pre-release survey, while only 23.2% said the same after the new models were released.

While both surveys were large enough that the data was likely reflective of the true intent of the respondents, the questions leaned a bit to the negative, so we point out again that the company doing the survey has a vested interest in getting folks to upgrade their phones. That said we were a bit surprised at the lack of enthusiasm expressed for the new models, although our initial reaction was a resounding, ‘more of the same’. There were a few oddities also, with the survey revealing that 18.3% of Apple users are triskaidekaphobic, meaning they have a fear of the number 13 (check to see if your elevator has a ‘13th floor’ stop…) and that 74% of those polled would prefer a different name than the iPhone 13. The survey results are shown in figs. 5 – 9 below.

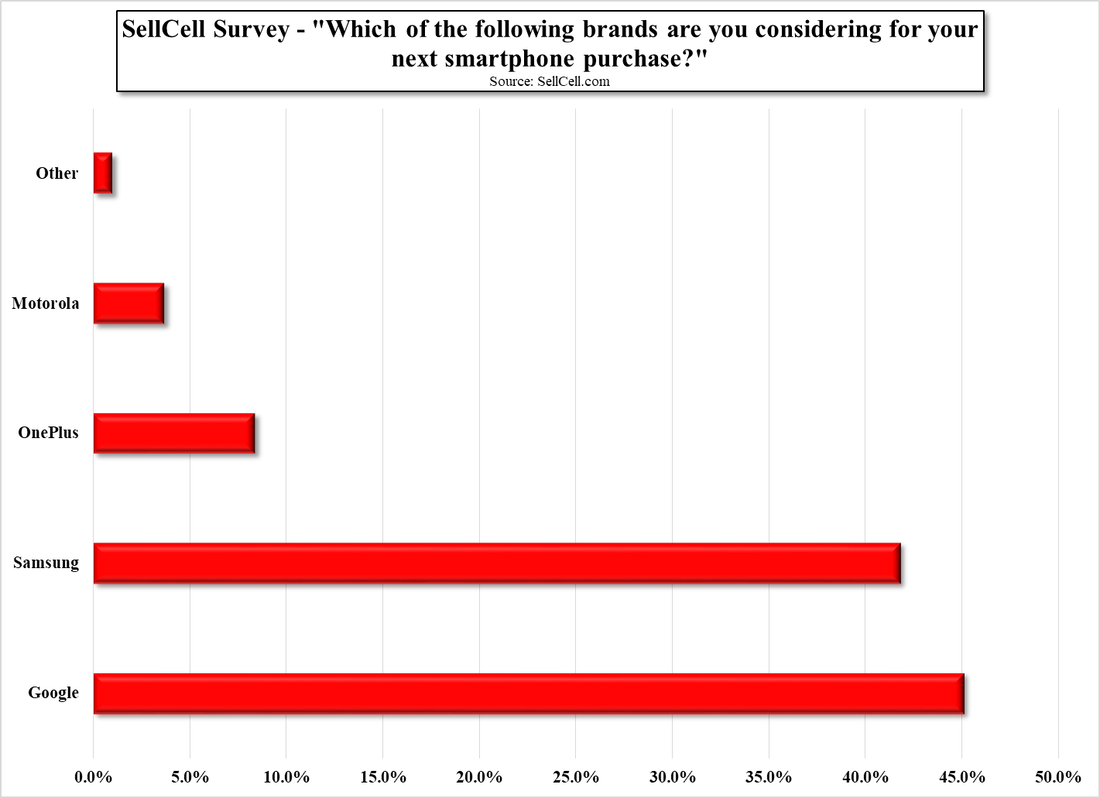

All in, Fig. 9 was the most surprising, as it indicated that the brand that iPhone users would most likely convert to was Google (GOOG), a relatively small name in the smartphone market, especially compared to Samsung (005930.KS) who came in lower than Google. The Google Pixel series has been compared to the iPhone at times and has a limited number of models, also similar to the iPhone’s offerings, but sell for considerably less than Apple prices. The Pixel does have a longer battery life than the iPhone 13, which was an important feature for the Apple crowd, but would likely perform much less ‘robustly’ when compared to the iPhone A15 Bionic processor.

[1] Included more than 5,000 iPhone users 18 or older, based in the US.

[2] Included more than 3,000 iPhone users 18 or older, based in the US.

RSS Feed

RSS Feed