QD/OLED Ready to Go?

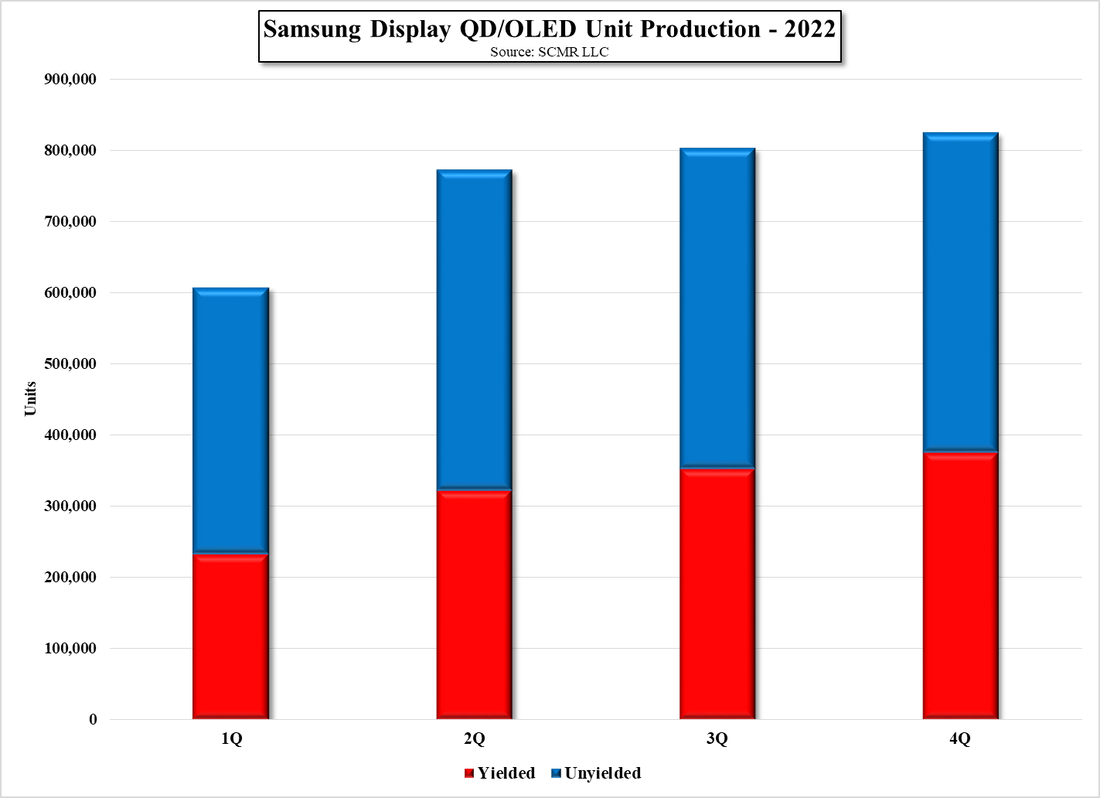

While we are optimistic about the prospects for QD/OLED, we are a bit conservative in what we believe can be produced in 2022, based on production limitations and yield more than demand. We expect production to be 1.32m units over the next 14 months ending 12/22, with 1.28m being produced in 2022 itself. We base these estimates on capacity and yield, using 55” and 65” displays only, as these are a logical combination using MMG (Multi-mode glass) on a Gen 8.5 line. When actual set shipments will begin and where the sets will be released is still quite speculative, and we note that our estimates are a bit lower than most we have seen.

RSS Feed

RSS Feed