Mini-LED/QD Obsession – Yes, More…

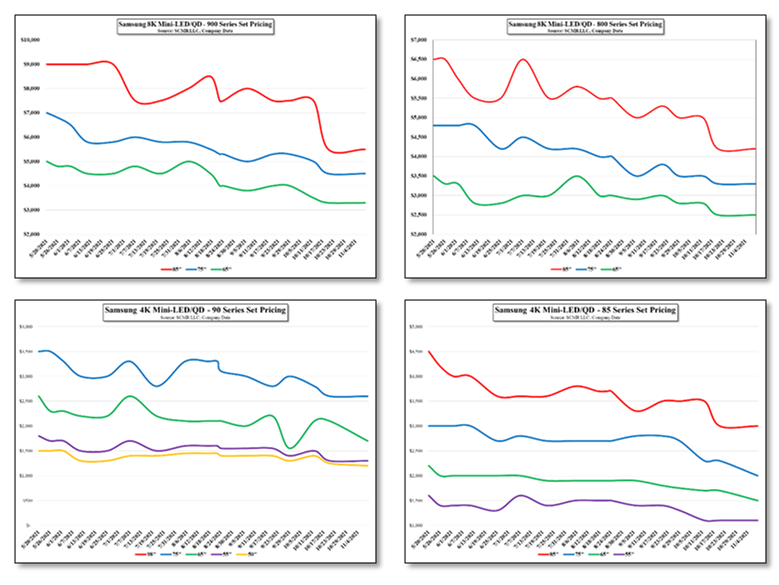

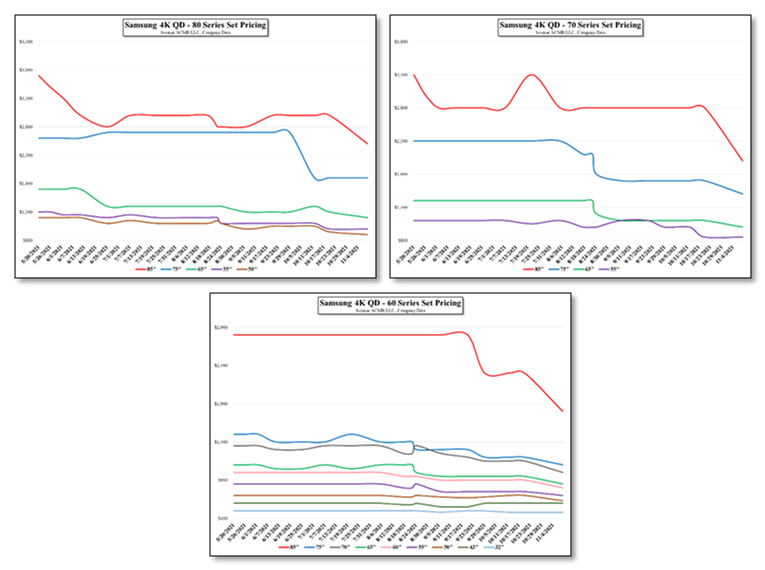

On a more general basis, much of the price reductions seen in our most recent check have taken place in the 4K Mini-LED/QD category and among sets that are just quantum dot enhanced, but looking at the entire list (excluding the two new entries), all but two of 33 (93.9%) are at their lowest point since initial release (5/20/21), with the average price decline 27.3%. The models with the greatest declines fall into the 8K Mini-LED/QD 900A Series (Top of the line), where prices have fallen 34.0%, and the middle price tier of 4K Quantum Dot sets, where prices are now 31.4% lower than initial release. When looking at all Mini-LED/QD TVs, the average price is now down31.7% and looking at all QD only TVs, the average price is down 23.6%. The average price reduction on those sets that saw m/m reductions was -12.3% and across all sets (including those that remained flat) the price reduction was 6.3%.

As we get closer to Black Friday (11/26), we expect another round of price reductions although it seems Samsung has most recently been focusing on lower priced sets, likely to meet unit volume targets. While we cannot check actual stock at Samsung USA, we did check to see how many models could be shipped ‘next day’, which would indicate stock at a nearby Samsung warehouse or distribution center. Of the 33 models checked (neither of the two new models were available), 66.6% were available for next day shipping with the remaining 33% shipping within 14 days, other than two models (8K 85” Mini-LED/QD top-of-the line $5,500 and 65” 4K Mini-LED/QD $1,700) that would not ship until 12/3/21, which would indicate stock is readily available for most models.

With 18 days to the first big holiday in the US, we would expect at least one more round of price reductions past the current discounts, which Samsung calls ‘Early Black Friday Deals’, and as the holiday selling season this year covers even more ‘holiday selling days’, given the progressively earlier ‘pre-pre holiday’ discounting already seen, we expect the Samsung Mini-LED/QD and QD only TV line will continue to see price reductions through the end of the year.

RSS Feed

RSS Feed