OLED TV – A Tougher Year

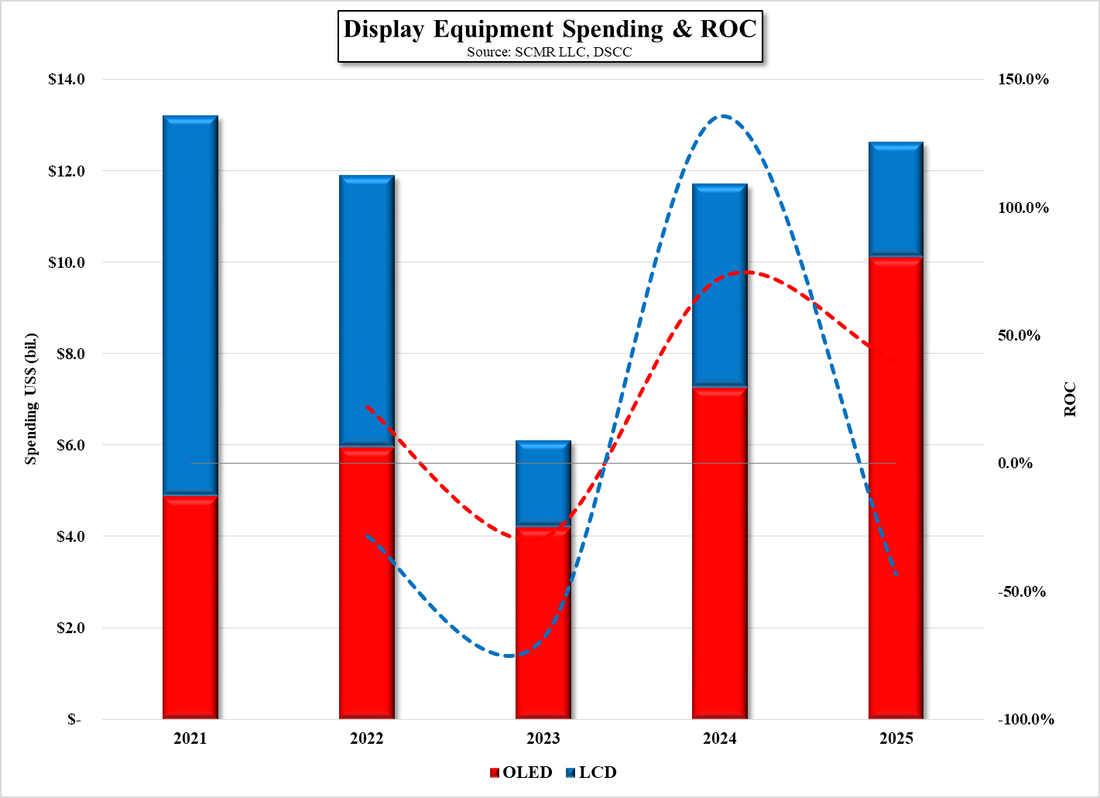

While we expect Samsung Display to increase its QD/OLED capacity over the next 18 months, overall OLED capacity seems static for the remainder of 2022 and at least the first half of 2023, if not the entire year. Estimates for display equipment spending overall have come down for this year as high inventory levels and declining panel prices have slowed expansion plans across the industry, and while spending for LCD will come down by 28.5% y/y spending for OLED (both large and small panel) is expected to increase by 21.9%. Both categories are expected to decline next year but return to growth in 2024 for both categories, while in 2025 LCD equipment spending is expected to decline while OLED equipment spending is expected to increase as shown in Figure 1. We are a bit skeptical as to by how much LCD and OLED equipment spending will decline next year and could foresee a scenario where some of the equipment spending currently estimated for 2024 and 2025 could find its way back into 2023, but for now the outlook for 2023 display equipment spending continues to look rather grim.

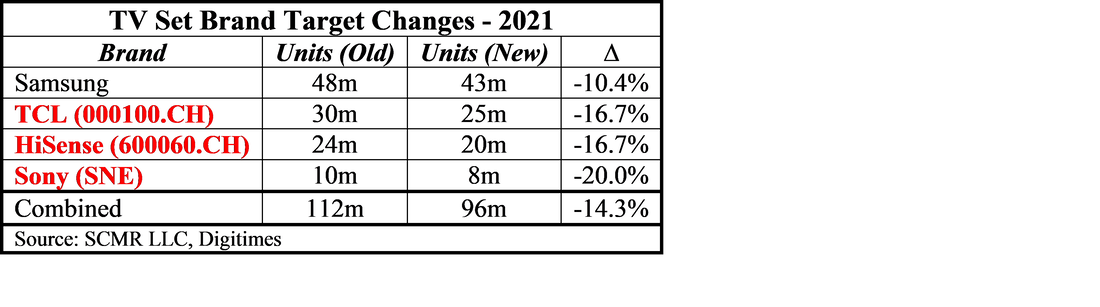

Along with the decline in spending this year and next comes the decline in TV set shipments overall, which have been declining yearly after peaking in 2020 during the early days of the COVID pandemic. Both Samsung (005930.KS) Electronics and LG Electronics (066570.KS), the leaders in TV set sales, are expected to see declines in shipments this year, leading to a unit volume decline in set units this year of ~3%. While we expect much of the unit decline will fall to generic LCD TV sets, the decline has put pressure on the overall TV market, including OLED TVs. With estimates of ~10m units for WOLED panel shipments this year, we believe that the potential for LGD to miss this target has increased, particularly given that the negotiations between Samsung and LG Display for the purchase of ~2m WOLED panels this year seem to have evaporated.

While Samsung Display’s QD/OLED shipments will be modest this year, likely under 1m units, they will also impact what might have been potential WOLED panel shipments from LGD, which adds to the possibility of a shortfall. On the positive side of the ledger, we expect Sony (SNE) to increase its presence in the OLED space, although they will be a QD/OLED customer, along with Samsung Electronics, which could lessen the positive impact of the Sony OLED expansion this year. Recently there have been rumors that utilization rates have dropped at LG Display’s E4 fab, the larger of LGD’s South Korean OLED fabs, which could indicate that like LCD panel producers, LGD is trying to work down some excess inventory. With 79 days until the unofficial start of the holiday season a slowdown in WOLED production does not bode well for the full year target of 10m units, however as long as the potential shortfall is not greater than 2m units, there will be some, albeit small, growth in the OLED TV business this year.

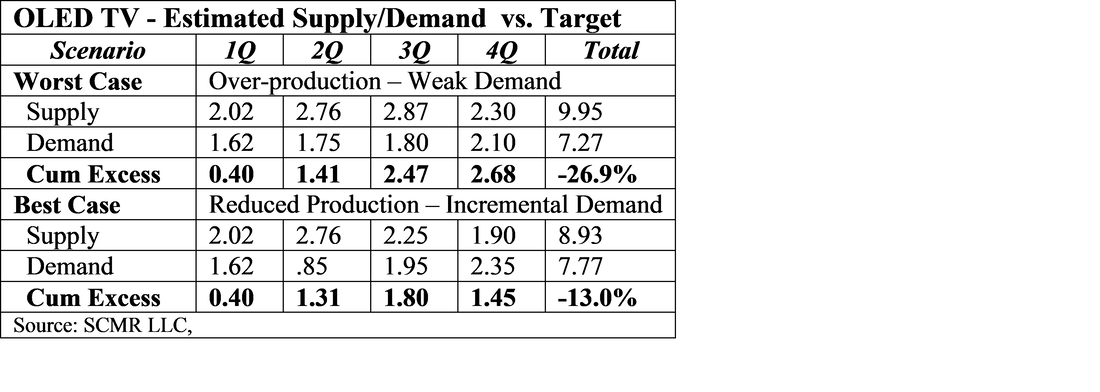

The bigger risk is that LGD continues to produce at a rate that gets it near or to its target of 10m panels as this will create an even larger inventory issue going into 2023. We expect production to decline by over 18% q/q in 3Q and by ~15% in 4Q, along with a modest (6.8%) increase in demand over the worst case scenario, which would create a 13.0% panel excess. Given a safety level of 10%, the best case scenario would set the stage for a better 2023, while the worst case scenario would create a ~27% excess in panel stock, making 2023 another difficult year. Much will rest on LGD’s production decisions and brand demand, but we expect TV brands are ordering on an almost day-to-day basis to try to gauge how consumer demand is flowing.

RSS Feed

RSS Feed