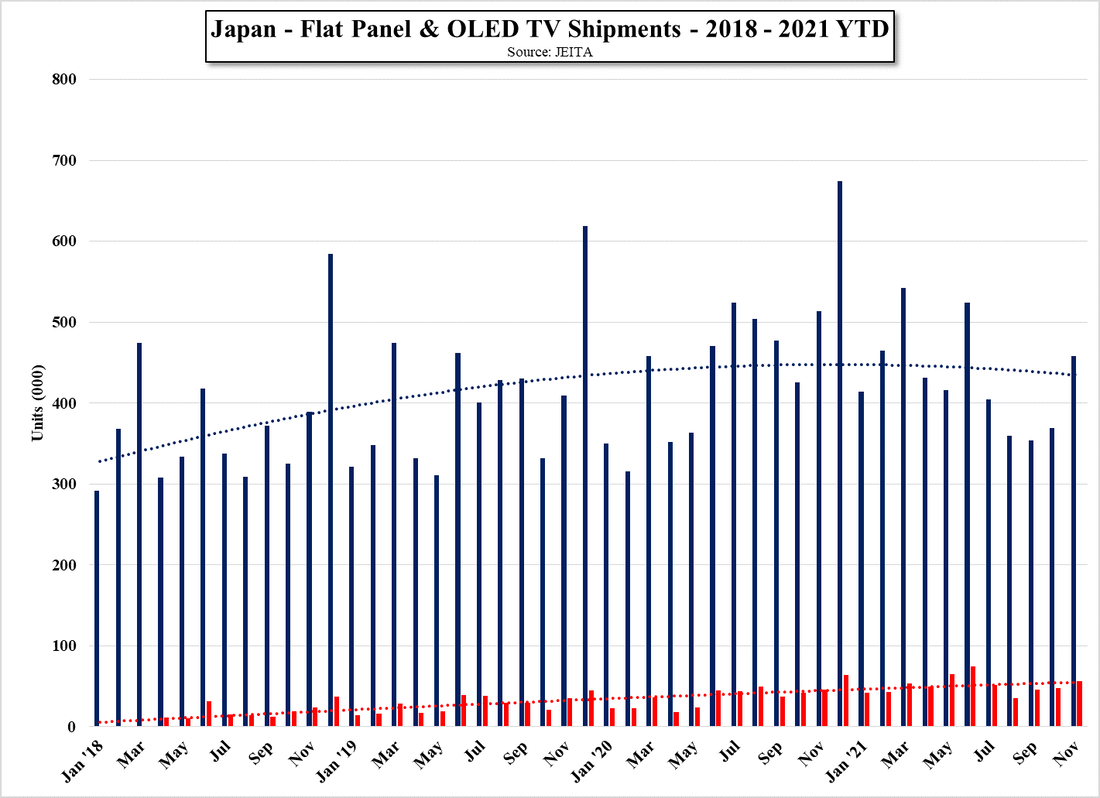

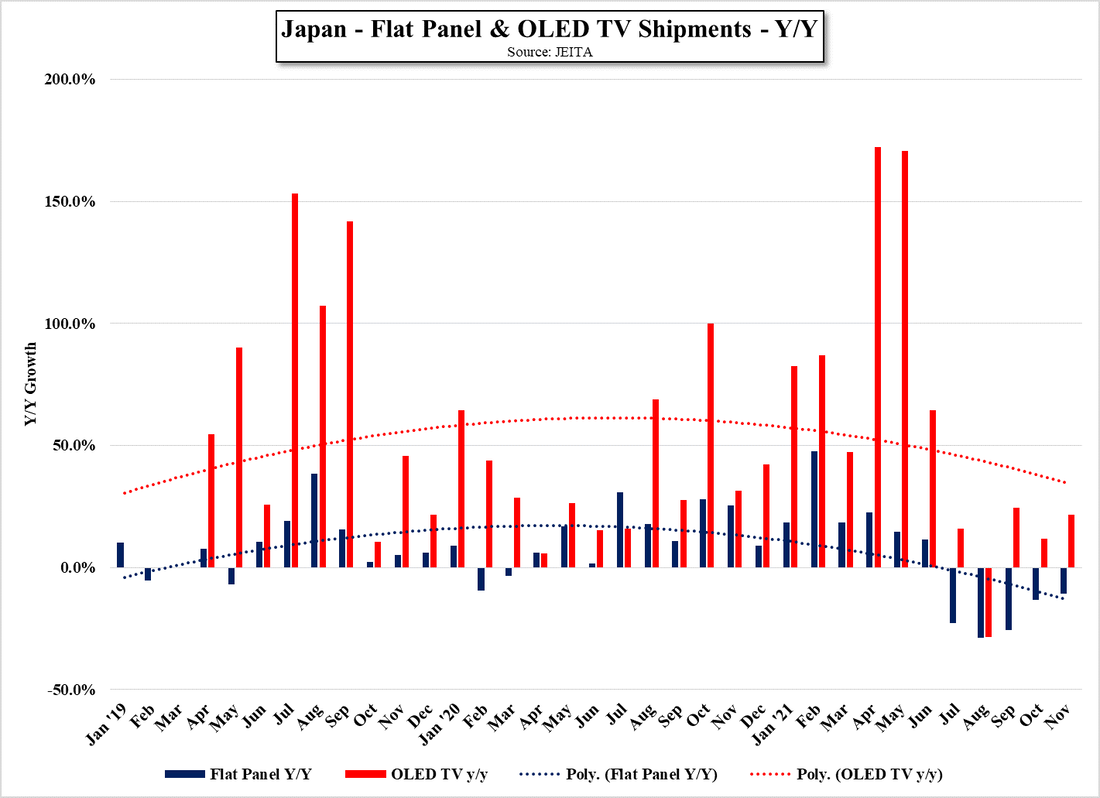

Fun With Data – TV Shipments – JapanWhile China gets much attention in the CE space, being the largest market for many CE products, and Japan represents ~2.5% share of the TV market, trends that appear in the largest markets should be mimicked in smaller markets. Japan’s TV shipment data has indicated that overall TV shipments have been declining, particularly in 2H of 2021, similar to most regions, while OLED TV shipments continue to grow, despite the overall slowdown. With OLED TV shipment tracking in 2018 beginning in April ’18, OLED TV share was only 3.8% of total flat panel shipments, rising to 6.8% in 2019, to 8.3% in 2020, and 11.8% in 2021 (excluding December). While there will likely be negative growth in Japan’s TV market in 2021, OLED TV units and share have been growing.

0 Comments

The Clicker |

AuthorWe publish daily proprietary market research focusing om consumer electronics and the global supply chain. The archieved notes represent a selection of our proprietary analysis and forecasts. please contact us at: [email protected] for detail or subscription information. Archives

January 2026

|

RSS Feed

RSS Feed