Remembering the Old Days

But our kids don’t remember any of that. They only know cable or streaming and don’t really get the concept of broadcast TV, and while they take large screen TVs for granted, they are just as happy to watch a movie on a 6.5” smartphone screen. OK, we are sounding like the old guy yelling at the neighborhood kids to get off the lawn, but the world of content viewing has changed quite a bit over the years.

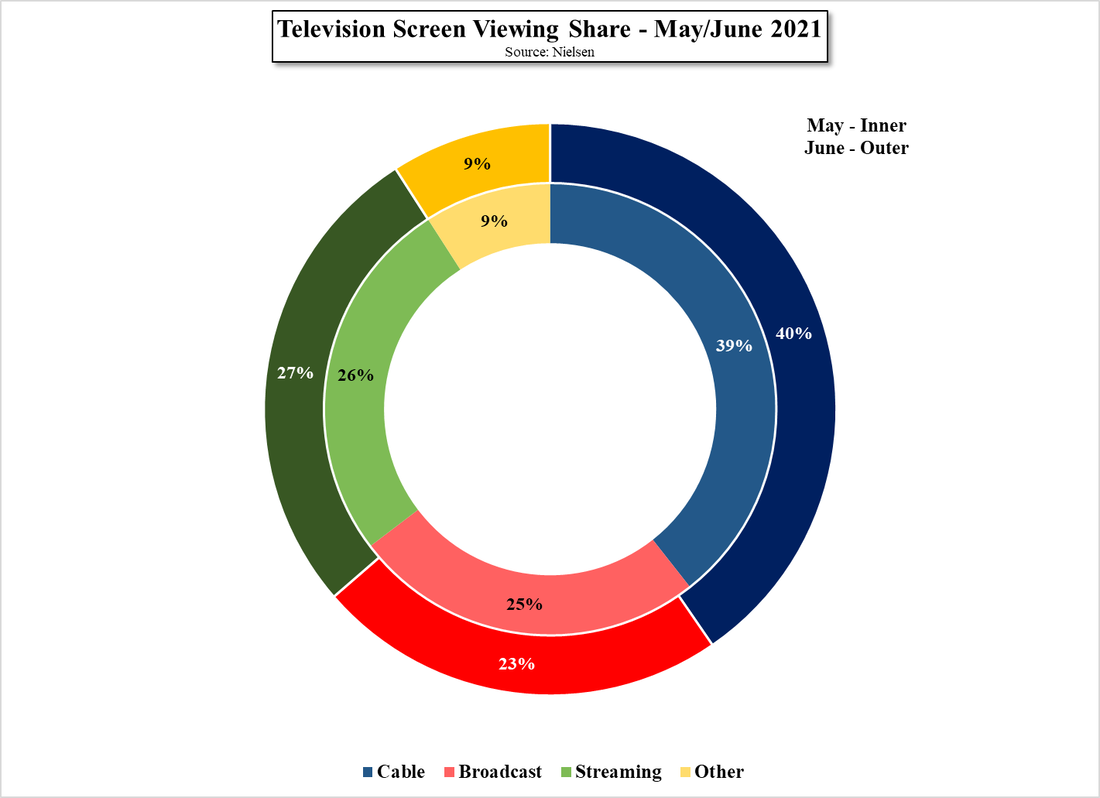

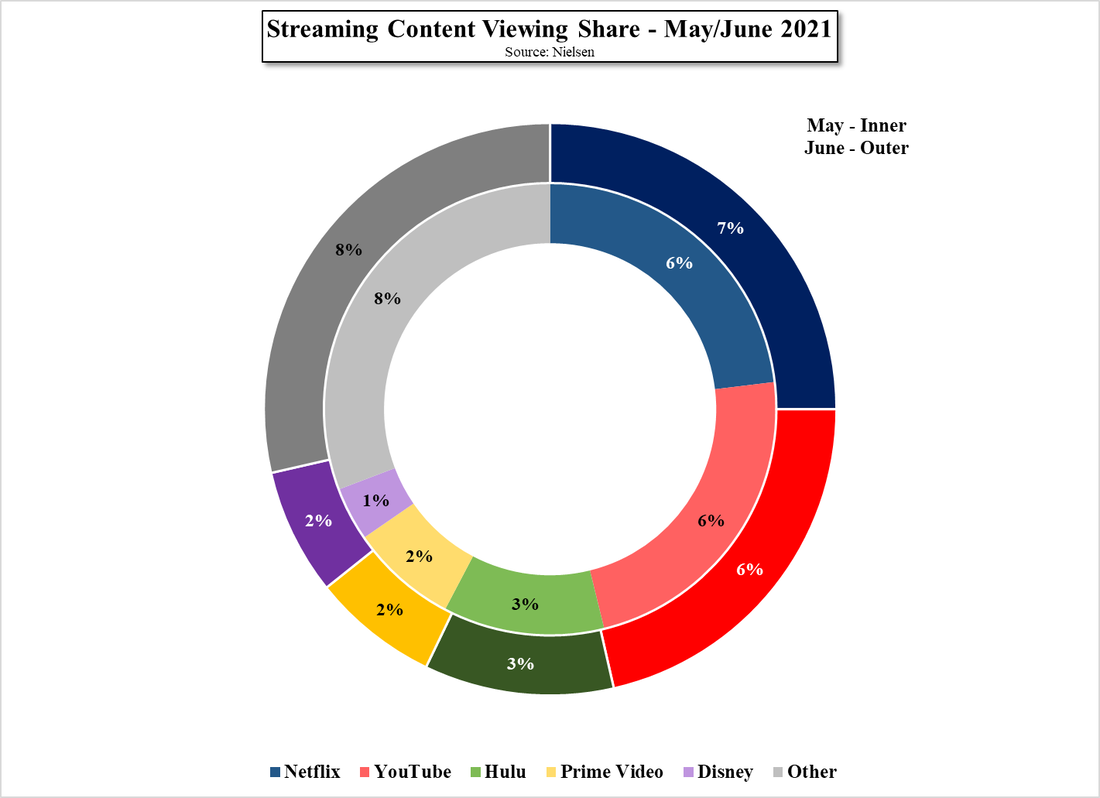

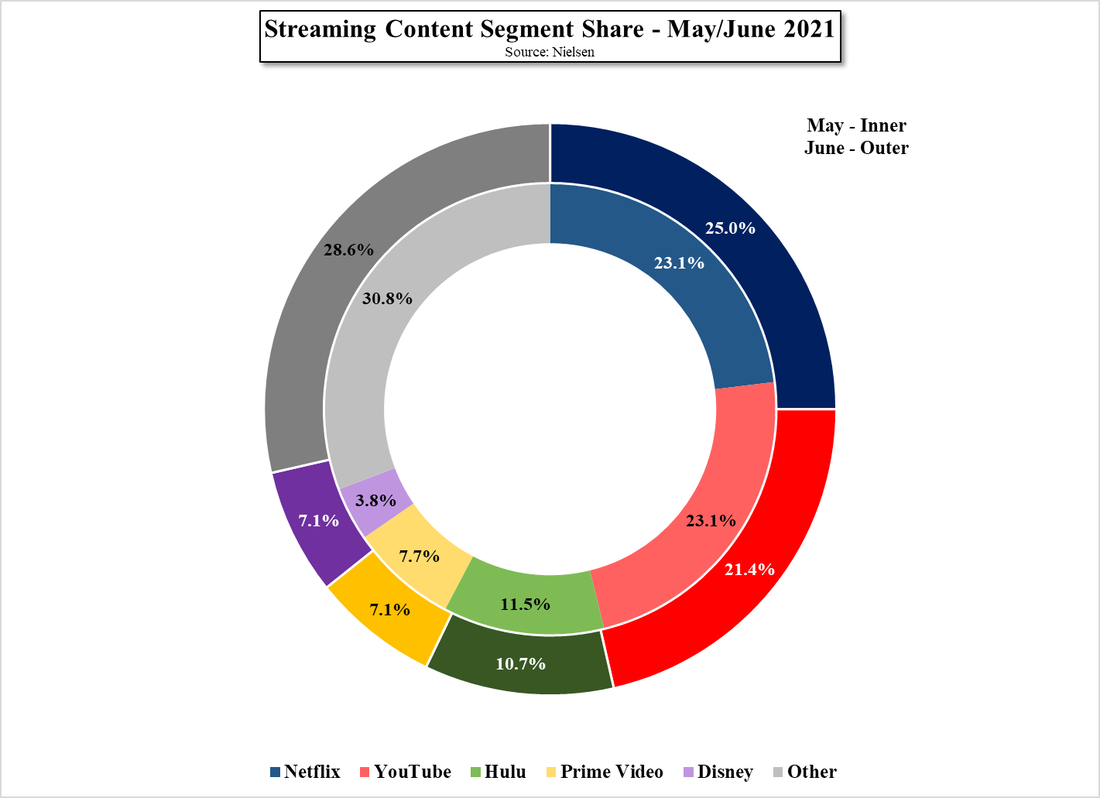

Nielsen (NLSN) has been measuring consumers since the 1920’s and the company’s founder was the ‘inventor’ of market share calculations, an outgrowth of their data collection services, which started with radio and migrated to a variety of consumer goods and eventually television. The company has recently begun to produce a new report called “The Gauge” that tracks TV screen time as it relates to both streaming and ‘linear’ (broadcast & cable) TV. Given that many of our kids view TV through wireless or IP based services, we were surprised to find that streaming was not the largest viewing service, and data from the last two months indicates that m/m changes are quite small, despite a variety of influences like sports and seasonality. Further, the competitive elements of the streaming segment itself are broken out in Fig. 3.

While the data Nielsen shows is not particularly granular, they did indicate that as the end of the seasonal broadcast season is May, June saw that segment decline, with that share picked up by both cable (sports) and streaming (new content), and while individual new streaming content titles themselves do not usually move the needle significantly, that new content does drive consumers to explore that particular content platform, which can lead to a bit of share gain. Noted were Disney’s (DIS) “Loki” and “Raya & the Last Dragon”, which moved to Disney+ ‘free’, and Netflix (NFLX) released “Manifest” and “Sweettooth” that helped move them up a notch. If Nielsen is kind enough to supply such data[1] on a monthly basis, we will track and post.

[1] All other TV includes AOT (ALL Other Tuning), VOD, Streaming through a cable set top box, Gaming, and other device (DVD Playback) use. Streaming via cable box is included in the ‘All other’ group. Streaming data comes from a subset of TV households in the National TV panel, while linear sources are based on viewing from the overall TV panel. Hulu includes Hulu Live. YouTube includes YouTube TV.

RSS Feed

RSS Feed