Oops – 5G

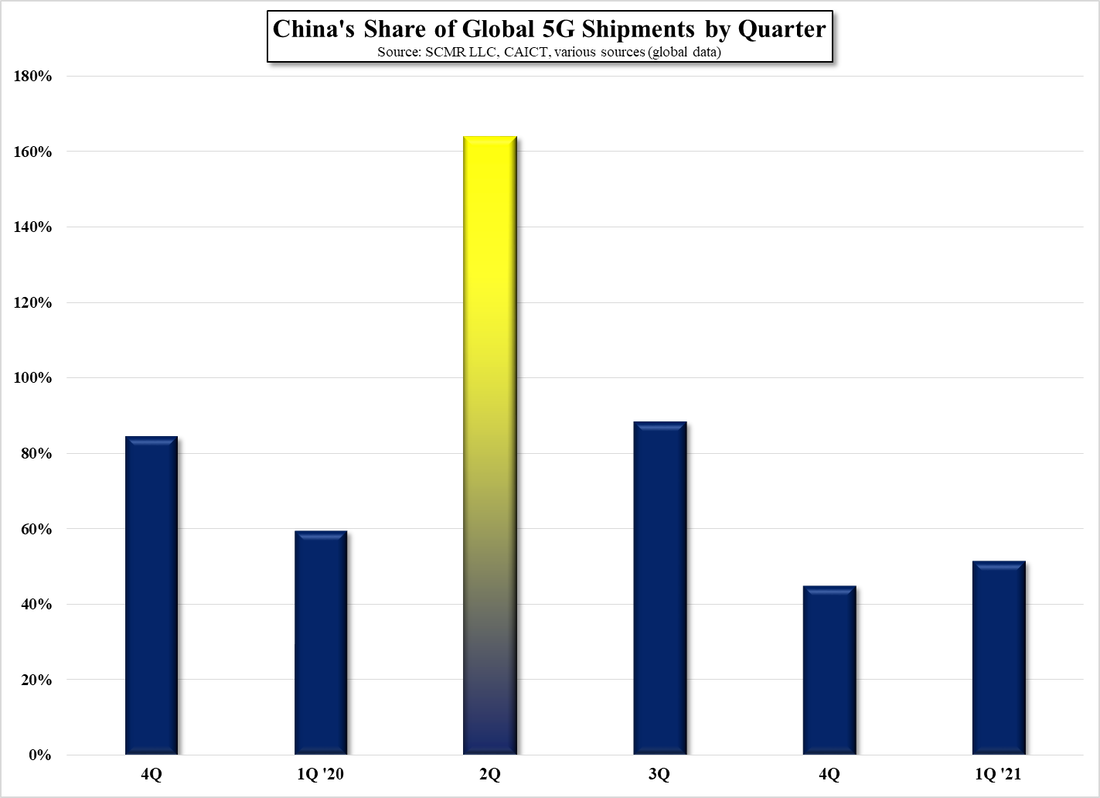

As we noted last week, there are discrepancies in the data provided by state sources in China, which call into question whether the data has been ‘colored’ by state objectives, and the subscription data mentioned above fuels that fire, and calls into question other data, such as the number of Chinese base stations deployed or the 5G coverage maps on the Mainland. While there is no way to drill down through the state data, as the carriers in China that provide the data are also state run, we have to take the numbers at face value, but with the same wariness of self-aggrandizement that we see in the display space. Words like ‘expect to’ or ‘according to market demand’ don’t always translate exactly or can be missing from press releases, which can lead to assumptions concerning 5G that are a bit more dubious than originally expected. It is interesting that ‘glorious’ or ‘industry leading’ always seem to be translated correctly however.

RSS Feed

RSS Feed