Visionox Announcement

That said, Visionox announced an order from Huawei spin-off Honor (pvt) and has seen shipments begin in 2Q from their OLED fab in Gu’an, however Visionox just announced expected results for the 1st half of this year and despite the order and overall strong demand for OLED products, the company is expected to show an operating loss for the period, against a profit last year. The announcement indicated that operating income for the 1st half will be between 1.35b ($208.7m US) and 1.55b yuan ($239.6m US), of which between $200m and $216m will be from OLED production, but net profit will be negative, showing a loss between $111m and $131m US.

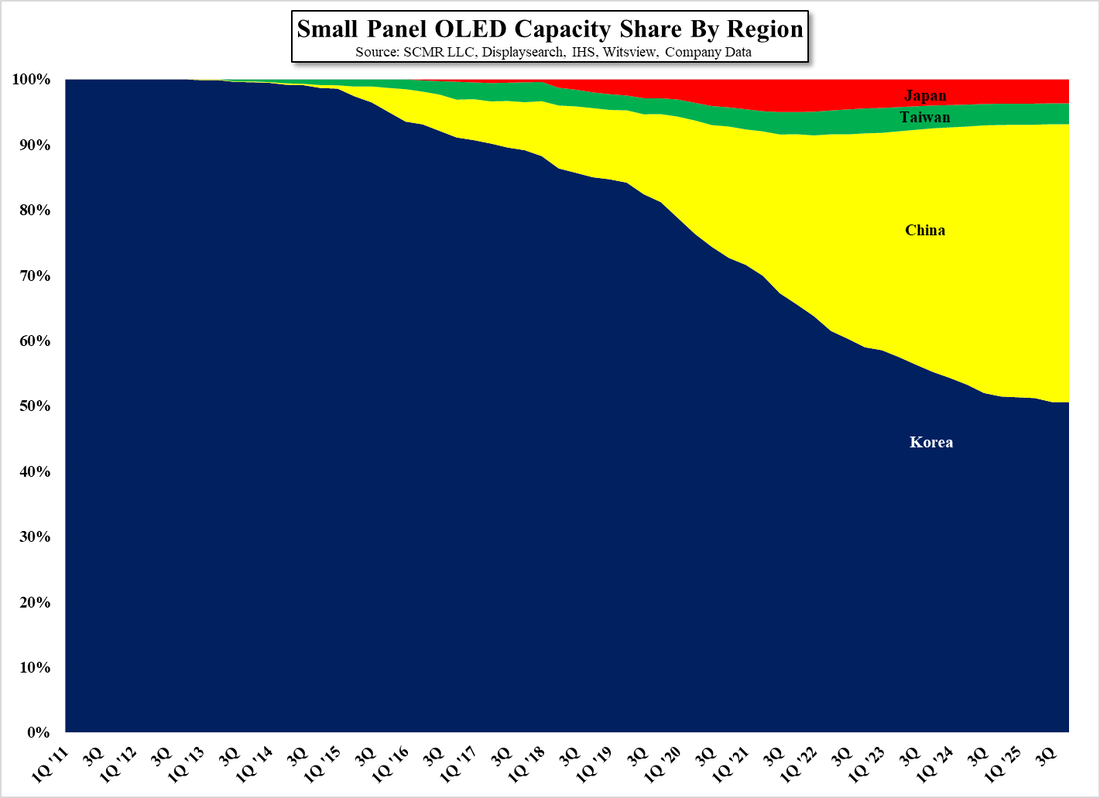

The announcement, which is citing unaudited estimates, indicated that while the order from Honor was being executed, the company faced increased R&D and labor costs relating to the production of the displays requested by Honor, licensing revenue that it derived from an affiliate last year would not be repeated this year, and lastly, while no details were given, changes in government subsidies were also a factor contributing to the loss, which we take to mean the subsidies were less than last year. Visionox is running two 15K fabs (Gen 5.5 and Gen 6) and is ramping up a 30K Gen 6 fab in Hefei, but reference to ‘continuing to improve’ in other comments by the company when referring to the two operating fabs gives us a reason to suspect that yield is what has been a stumbling block for the company, while others in the industry are seeing some of the best results in the last few years on rising panel prices.

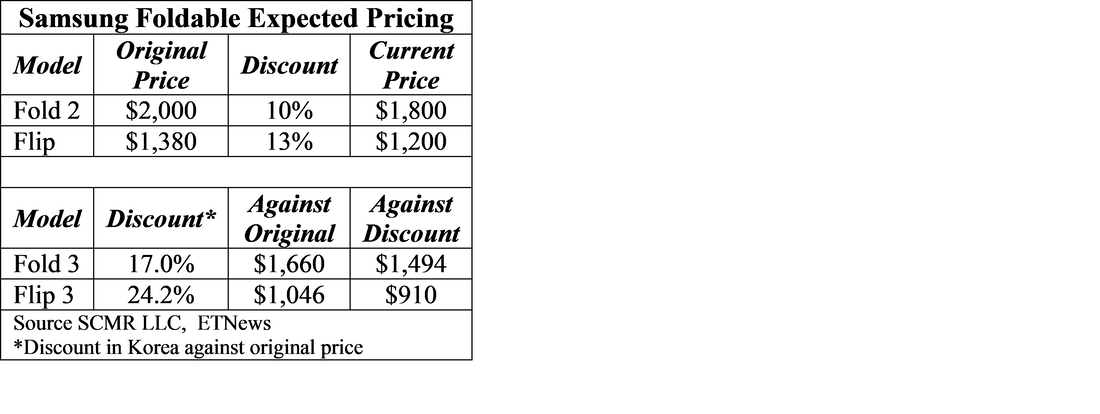

There has been speculation that Visionox is working toward the development of a foldable display for the Honor Magic device expected later this year, which would certainly account for a substantial increase in R&D, and at the same time Visionox is upgrading its under-screen camera project, for which it claims global leadership, with an earlier version adopted by ZTE (000063.CH) for its Axon 20 5G released last September. While Visionox showed a profit in 1H last year, without as much government help and the demands of a large customer, the operation of LCD or OLED fabs is not a guarantee of profitability, and such a struggle by Visionox justifies the many comments made by panel producers outside of China who have little financial help from their governments and in many cases continuing pressure to perform from shareholders. Such producers have a completely different view of capex and regulating operating expenses than those who are subsidized, particularly when initiating new construction, and while the eyes of the government are certainly on Chinese display producers, those eyes change every few years and jobs created help to justify weak operating results. Hopefully Visionox gets the message before the cycle changes.

RSS Feed

RSS Feed