Display Driver Discourse

While the complexity of display drivers is such that they do not have to be produced on 7nm or 5nm nodes, they do have to contend with other products that are produced in large process formats and for much of 2H ’20 and 1H ’21 display drivers for a variety of display products were in short supply. This limited some display producers, particularly the ones that sold display modules, but most panel producers provide “open cell” displays, that is displays with no backlight, bezel or drivers, which gave them the opportunity to claim that a shortage of display drivers had ‘no direct effect’ on their business. That said, those companies that packaged those open cell displays into modules, many of which are subsidiaries of display producers, found that such shortages either pushed out delivery dates or limited certain models.

The semiconductor space continues to see tight conditions, with wafer shortages, mask shortages, and a variety of issues that have extended delivery schedules and put semiconductor applications in contention for fab production time. But there is some good news; Display drivers are no longer seeing allocation issues and have become more widely available. How has this happened? Has the semiconductor industry put display drivers ahead of other critical components, putting aside automotive silicon, 5G RF, or even microprocessor production for the lowly display driver? No, but something has changed.

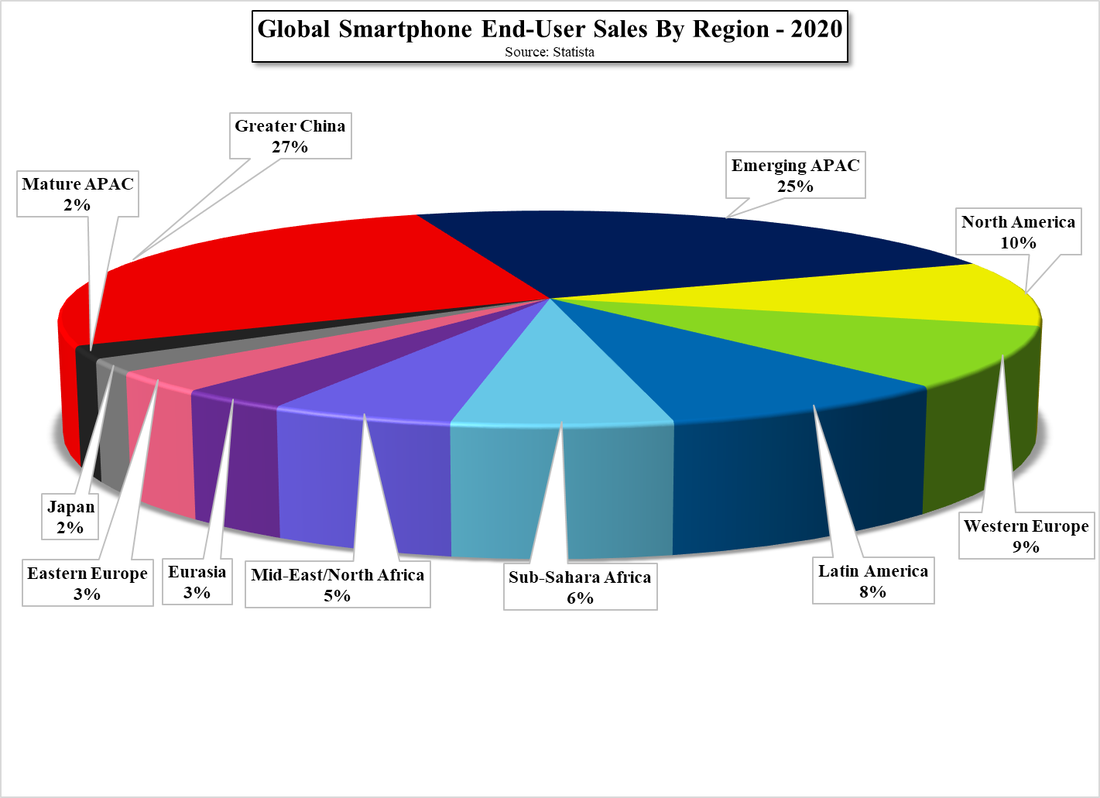

That change is demand, and as the price of displays, particularly TV displays rose to a point where consumers began to slow purchases, the price of TV panels fell and TV brands began to reevaluate their targets for this year. As demand declined, which has happened over a relatively short period of 2+ months, panel producers began to cut back on TV panel production, and ipso facto, demand for display drivers also weakened, although demand for IT products kept the driver market from deteriorating rapidly. Now it seems that the display driver market is more in balance with demand, and driver demand is returning to segment imbalances rather than total market issues.

Demand for OLED drivers remains strong as Apple (AAPL) is in full production mode for the iPhone line and notebook and monitor demand is still a bit above production, but a more reasonable balance for drivers has been the result of the production cutbacks in the TV space. It is always surprising to see how quickly a change such as has been seen in the panel space can affect other components, but while shortages are part of such a cyclical industry, they can disappear in a very short time as the balance between supply and demand swings from one side to another, or even moves away from peak by just a bit. While we know that change is an integral part of the CE space and likely keeps CEOs up at night, even small changes filter through the supply chain quickly and can change to course of component suppliers almost overnight.

RSS Feed

RSS Feed