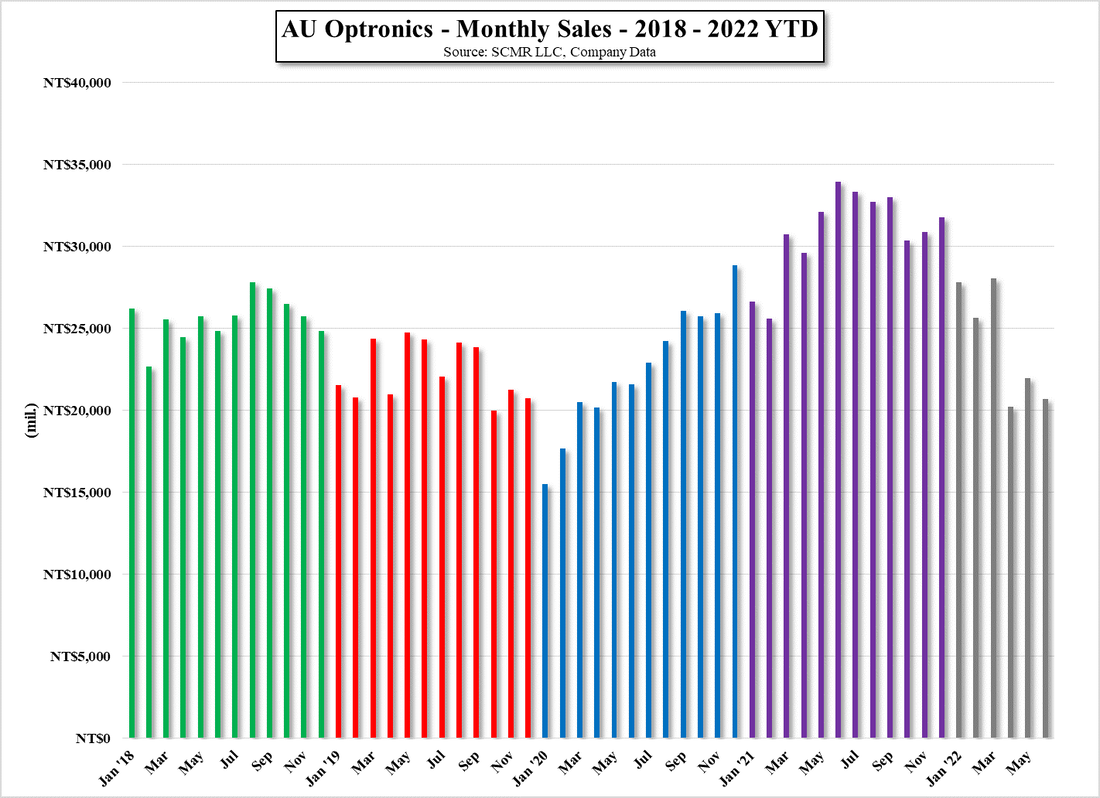

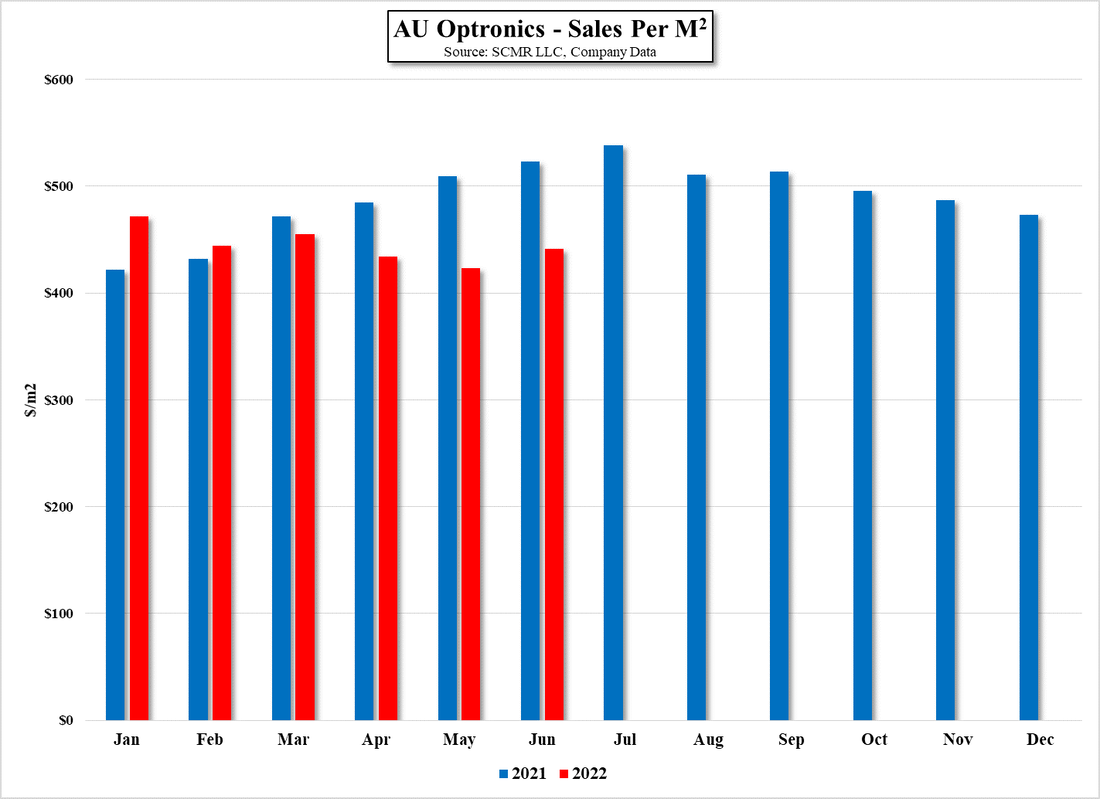

More Taiwan Display DataYesterday we mentioned the extremely poor January results from one of the two large panel LCD display producers in Taiwan, Innolux (3481.TT). The other, AU Optronics (2409.TT) reported January results last night that were also weak, but not quite as weak as those from Innolux. AUO reported January sales of 15.91b NT$ ($528.7m US), down 11.4% m/m and down 42.7% y/y. Typically (5 yr. including 2022) January sales are down 20.6% m/m so from that perspective AUO saw better results, but being down 42.7% y/y shoouof as ‘good’. While AUO does not report large and small panel detail, they do report total area shipped, which in January was 1.25m m2, down 18.8% m/m and down 37.5% y/y, which would imply that AUO continued to maintain or increase low utilization rates in January, an important point in understanding how display producers are reacting to the current demand weakness. All in, AUO’s January monthly results were as expected to slightly better than expected.

0 Comments

Hope Springs Eternal |

AuthorWe publish daily proprietary market research focusing om consumer electronics and the global supply chain. The archieved notes represent a selection of our proprietary analysis and forecasts. please contact us at: [email protected] for detail or subscription information. Archives

January 2026

|

RSS Feed

RSS Feed