BOE starts shipping from new Fuzhou Gen 8.5 line

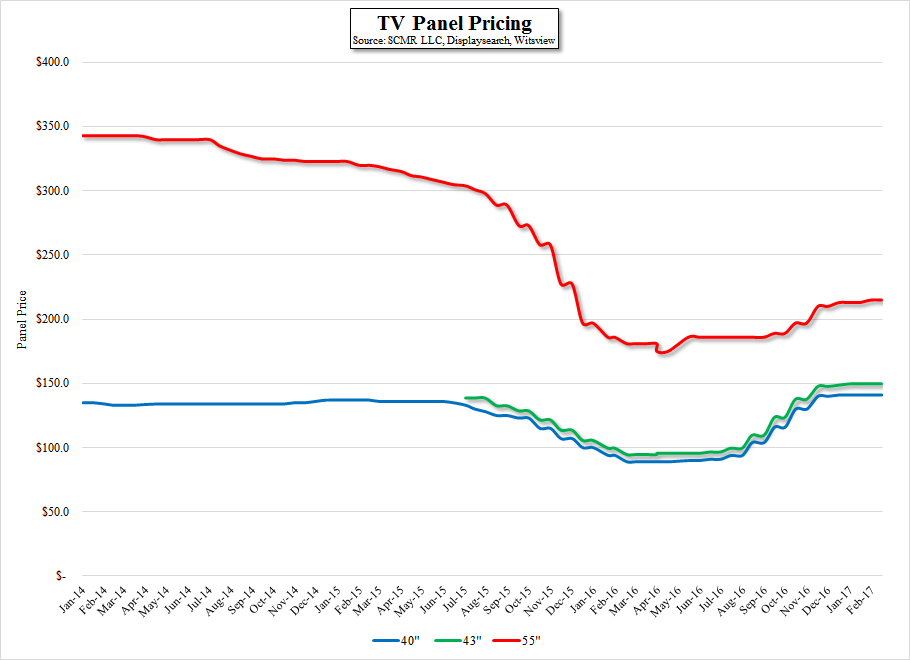

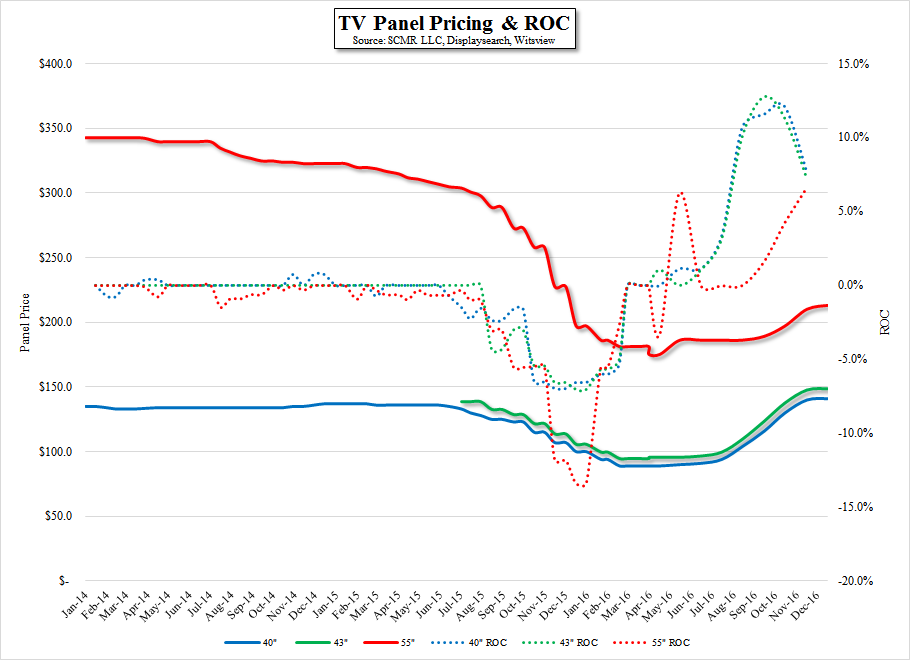

We note that our previously updated expectations for production from this new BOE LCD line were for a gradual ramp starting in March and full phase 1 capacity (330,000 m2/month) by early 2018. We now accelerate that production schedule by ~ 4 months. While on an industry basis, this will only add ~0.2% to the total industry capacity for the year, it is an indication of how aggressive BOE, and other Chinese panel producers are on adding capacity. Further, BOE will be producing 43” TV panels at this plant, a substitute for 42” TV panels which are in short supply and have seen continual price increases after the closing of Samsung’s L7-1 LCD line, which is being converted to OLED production. While we expect BOE to take full advantage of the higher TV panel prices, we also expect to see some volume discounts established in order to fill the fab as quickly as possible, and BOE is able to produce 43” panels more efficiently than typical for 42” panels, which gives them some leverage in their price negotiations.

RSS Feed

RSS Feed